Our Portfolio

Units Acquired

Total value of assets acquired

Properties Acquired

Unique Asset Classes

Asset Locations

Watch Our 2024 Shareholder Event

For the latest updates on our entire portfolio

Previous Offerings

-

Salem Storage Fund

5 Years Hold Time

16.5% Annualized Return

1.83x Equity Multiple

4-8% Cash Flow

-

Cortland Vizcaya

5 Years Hold Time

20.8% Annualized Return

2.04x Equity Multiple

6-7% Cash Flow

-

Bel Aire Industrial

3-5 Years Hold Time

20-25% Target Annualized Return

1.5-2.0x Target Equity Multiple

7% Preferred Return

-

Lakes at 610

5 Years Hold Time

22.6% Average Annualized Return

2.13x Target Equity Multiple

8% Preferred Return

-

Sunrise Infinity Fund

16% Target Annualized Return

∞ Hold Time

7-8% Target Cash Flow

5-7 Years Return of Capital

80-100% Year 1 Depreciation

-

Denver Workforce Multifamily Fund 1

2-4 Years Hold Time

18-22% Projected Returns

1.6-2.0x Equity Multiple

4-6% Average Cash Flow

7% Preferred Return

-

Diversified Storage Growth Fund

5 yrs Hold Time

24.8% Target Annualized Returns

15.5% Target IRR

2.38x Target Equity Multiple

8% Preferred Return

-

Four Mile Ranch

4-7 Years Hold Period

30%+ IRR

3.0-4.0x Equity Multiple

-

Aspen Energy Fund 1

5-10 yrs Hold Time

15%-30%+ Annualized Projected Return

25-30% Leverage Ratio

4.0-7.0x Equity Multiple

-

Houston PFC Portfolio

5 Year Hold

6% Passive Income During Hold

72% Projected Return on Sale

18-21% Projected Average Annualized Return

2.03x Projected Equity Multiple

-

Ironhorse | Industrial Development

2-3 Year Hold

0% Passive Income During Hold

40-60% Projected Return on Sale

20-25% Projected Average Annualized Return

1.40-1.60x Projected Equity Multiple

-

Superhost STR Fund | Short Term Rental Portfolio

5 Year Hold

6-11% Passive Income During Hold

51% Projected Return on Sale

21-26% Projected Average Annualized Return

1.9-2.5x Projected Equity Multiple

-

Thrive Fund 1 | Mobile Home Park

5-10 Year Hold

11-12% Passive Income During Hold

100% Projected Return on Sale

20.6% Projected Average Annualized Return

3.06x Projected Equity Multiple

-

Rise Suncrest | Multifamily

5 Year Hold

3-7% Passive Income During Hold

68% Projected Return on Sale

18.9% Projected Average Annualized Return

1.95x Projected Equity Multiple

-

Rise Encore | Multifamily

5 Year Hold

3-6% Passive Income During Hold

66% Projected Return on Sale

19.4% Projected Average Annualized Return

1.97x Projected Equity Multiple

-

Rise District | Multifamily

5 Year Hold

3-10% Passive Income During Hold

71% Projected Return on Sale

20.7% Projected Average Annualized Return

2.02x Projected Equity Multiple

-

Independence Storage | Office to Self Storage Conversion

2-5 Year Hold

0% Passive Income During Hold

167-302% Projected Return on Sale

28-40% Projected Annualized Return

1.67-3.02x Projected Equity Multiple

-

The Phoenix Portfolio (TPP) | Multifamily

5 Year Hold

3-8% Passive Income During Hold

73% Projected Return on Sale

19.6% Projected Average Annualized Return

1.98x Projected Equity Multiple

-

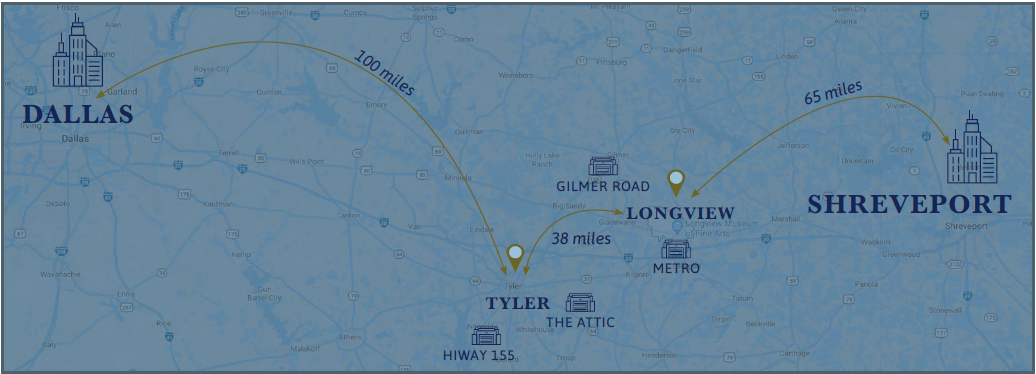

DFW Portfolio | Self Storage

5 Year Hold

5-9% Passive Income During Hold

49% Projected Return on Sale

18.1% Projected Average Annualized Return

1.9x Projected Equity Multiple

-

Southeast Portfolio | Self Storage

4-5 Year Hold

4-6% Passive Income During Hold

73% Projected Return on Sale

18.6% Projected Average Annualized Return

1.93x Projected Equity Multiple

-

Huntsville | Self Storage

5 Year Hold

5-7% Passive Income During Hold

68% Projected Return on Sale

17.8% Projected Average Annualized Return

1.89x Projected Equity Multiple

-

Tyler Longview | Self Storage

5 Year Hold

5-11% Passive Income During Hold

71.7% Projected Return on Sale

21% Projected Average Annualized Return

2.12x Projected Equity Multiple

Ready to start your wealth building journey?

At Turbine Capital, we’re here to help you build true, diversified wealth. So you can spend less time airborne, and more time with your family— living a meaningful and intentional life by design.

If you’re ready to kickstart your journey, join our Investor Club today.